Lease GAP Insurance Explained

What is Lease GAP insurance?

Lease GAP insurance is a financial product often sold when you buy or lease a car. It is designed to protect you against financial loss if your car is declared a total loss by your motor insurance company following a fire, theft or accident.

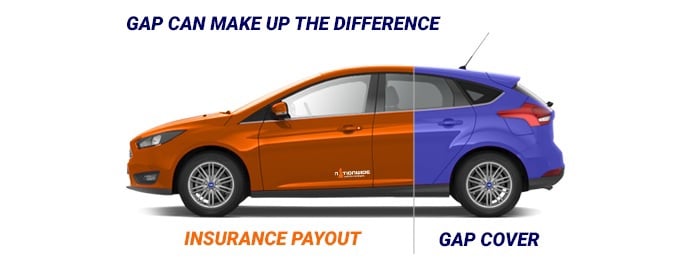

If your vehicle is written off (damaged beyond repair) by your motor insurer, there may be a ‘gap’ between what your insurer pays out and what you still owe on the car. A Lease GAP insurance policy covers the monetary difference between the motor insurer pay out and the amount needed to pay the outstanding balance on your finance settlement.

How does Lease GAP insurance work?

If your vehicle is stolen or written off in an accident during your leasing period, your insurer will usually pay out what it's worth based on its market value at the time of the theft or accident. For brand new cars, this is likely to be less than what you owe on the finance agreement meaning there may be a 'gap' between the amount your insurer pays and the amount outstanding on the finance settlement.

Lease Gap insurance example

For example, you decided to lease a Volkswagen Golf worth £16,995 over three years and paid an initial rental of £1500. Three years later, the vehicle was stolen or written off. Your insurance company will usually pay you the fair market value (what your Golf is worth on the day it was stolen) which according to today’s calculations is in the region of £8,688.

Your finance company send you a settlement letter of £11,700. This means that you now have no car, no initial rental and still owe the finance company £3012.

In this example, a Lease GAP insurance policy would pay the difference between your Golf's valuation on the day it was written off and the outstanding finance, leaving you with no financial liability to your old car and free to lease another vehicle. Without a Lease GAP insurance policy, you would need to find this shortfall elsewhere, either by using savings or re-financing the balance.

How does Lease GAP insurance differ from my regular motor insurance?

Lease GAP insurance is a financial product designed to work alongside your motor insurance. Even if your car insurance is fully comprehensive, you can still lose money if your brand new car is declared a total loss by your motor insurer. This is because most brand new cars lose their value very quickly from the point of purchase.

When you lease or buy a new car or van, it is an accepted fact that the value of it drops as soon as you start driving it and continues to depreciate over the years. How much a vehicle depreciates depends on lots of things such as the model of car, how old it is, how many miles it's covered and the condition. The AA estimate that the average car value falls by 40% in the first year and up to 60% in the first three years of ownership. This means that if your new car cost £20,000, it might only be worth £8,000 after three years. This may result in a shortfall between the price you paid at the outset (or took out on finance) and the amount you receive from your insurer.

Why is Lease GAP insurance important?

To consider whether Lease GAP insurance is right for you, you need to think about the types of scenarios that could happen during the period of your lease contract, such as:

Car Theft:

Each year in the UK over 150,000 cars are stolen making car crime a huge and profitable business, costing billions of pounds a year and representing around a third of all reported crime. It is also estimated that 70% of stolen cars are broken up and sold for spares, while the rest are given a false identity and sold or exported to other countries, making it more difficult than ever for the authorities to recover a stolen vehicle.

Accident Beyond Repair:

Analysis by HPI reveals that around 500,000 vehicles are written off a year. Further research by Churchill Car Insurance estimates that nearly 34,000 of claims made in 2016 were made on vehicles less than five years old, with the average claim value standing at over £9,000.

Fire:

Vehicle fire is often forgotten about but statistics show that there were 50,800 vehicle fires in the UK in 2007. While most assume car fires are the results of crashes or collisions, many occur actually while the car is in normal use. Statistics from the Home Office show at least 28% of fires are electrical and 39% are suspected to be caused deliberately.

What are the benefits of Lease GAP insurance?

While Lease GAP insurance is not compulsory, it is a popular product for customers on a finance agreement like contract hire because they usually have little, no or negative equity in their vehicle. This means they may end up owing more than the value of the car if the vehicle is declared a total loss by their motor insurer.

Key benefits include:

- Protects you from financial detriment

- Protects your savings

- Enables you to be able to set up a new lease immediately and get back on the road

Lease GAP insurance could be useful to have if:

Replace Vehicle

You wouldn’t be able to afford to replace your car

Balloon Payment

Your finance arrangement means you’re due to be left with a big lump sum to pay at the end, also known as a ‘balloon payment’

Long-Term Agreement

You are on a long-term agreement (over three to five years)

Low Initial Rental

You paid a low initial rental on your agreement (e.g. 20%)

Contract Hire

You are on a contract hire deal

Which sort of Lease GAP Insurance policy do Nationwide Vehicle Contracts offer?

Our Lease GAP insurance is specifically designed for vehicles on Contract Hire and Personal Contract Hire agreements.

A Lease GAP insurance policy pays the monetary difference between the amount owed on a finance agreement (i.e. the lease) and the market value at the time of the claim. This leaves you with no liability to your old vehicle.

Lease GAP insurance offers many advantages including:

- Total loss cover with a maximum benefit of up to £15,000, £25,000, or £35,000 as specified in the policy schedule

- Up to £500 towards your own motor insurance excess, where it cannot be recovered from any liable third party

- Up to £2,000 of the initial rental amount made when starting your lease agreement

- A contribution of up to £30 per day towards a temporary replacement vehicle for up to 30 days

- Up to £500 towards motor insurance excess for successful claims not related to a total loss

Is Lease GAP insurance compulsory when leasing a vehicle with Nationwide Vehicle Contracts?

Lease GAP insurance is an optional product and is not legally required when you lease a vehicle with Nationwide Vehicle Contracts. Whether you choose to take out a Lease GAP insurance policy is up to you however it is worth noting that you only have a limited amount of time to take out the policy. Please get in touch if you have any questions.

As with every type of finance product, it is important that you fully research the benefits and features and exclusions before taking it out to ensure it is right for you.

What should I consider before taking out Lease GAP insurance?

A Lease GAP insurance policy may not be suitable for everyone, therefore, it worth considering a few factors that may influence your decision.

Lease GAP insurance may not be suitable if:

- You took delivery of your lease vehicle more than 90 days ago

- You can afford to make up for any shortfall

What does GAP not include?

As with every type of finance product, it is important that you fully research the benefits, features and exclusions before taking it out to ensure it is right for you. It is also important that you ask questions on anything you do not understand or need any clarification on.

Lease GAP insurance might not cover you for:

- Any discount and/or contribution, road fund licence, delivery charges, number plates, new vehicle registration fee, administration fees, fuel, paintwork and/or upholstery protection kits, cherished number plate transfers, insurance premiums (including for this policy), service or maintenance packages, subscription charges or warranty charges.

- Any finance arrears and associated costs, any negative equity and any VAT if you are VAT registered and able to reclaim the VAT element.

- Any amount relating to grants, scrappage schemes, cash back schemes and battery hire or leasing.

- Any deductions made by the comprehensive motor insurance provider, for reasons including but not limited to any damage not associated with the total loss claim or relating to the general condition of the vehicle, and any non declared circumstances where deductions have been made by the motor insurer.

- Any claim where the comprehensive motor insurance provider has offered to repair the vehicle and you have requested the claim to be dealt with on a total loss basis.

- Where you are entitled to or are offered a replacement vehicle under the terms of the comprehensive motor insurance.

- Where the vehicle is covered under any type of comprehensive motor insurance connected with the motor trade.

- Where the vehicle or the driver is not covered by comprehensive motor insurance at the date of loss.

- Any additional costs or charges incurred as a result of entering into an agreement with a third party for a temporary replacement vehicle.

- Any additional excess reimbursement where the value of the claim does not exceed the excess under your

motor insurance policy; or the excess was waived or reimbursed; or the motor insurance claim was for glass repair or replacement or for damage which occurred during routine servicing or repair.

How much does Lease GAP insurance cost?

Nationwide Vehicle Contracts can offer Lease GAP insurance from as little as £168 for up to £15,000 worth of cover. This premium price provides cover for the full term, is not annually renewable and includes Insurance Premium Tax.

You can choose to pay for the GAP insurance premium as one lump sum or by 10 monthly direct debit instalments. If you wish to pay for the premium in full, this is payable by debit or credit card or by BACs payment.

More details about Gap Insurance can be found on our GAP Insurance FAQ Page.

Looking to lease a vehicle? Nationwide Vehicle Contracts offer various car leasing services to suit your every need, such as our fast car lease service which comes with a delivery time of three to four weeks (times may vary).

Guide Information

Originally published: 14th December 2017

Last updated: 10th December 2024